Ethereum Price Test: This Key Support Stands Between ETH and Deeper Losses

CryptoPotato

2025-08-20 21:35:48

Ethereum recently faced heavy selling pressure near the $4.8K region, echoing the heightened volatility seen across the broader crypto market. While the long-term bullish structure remains intact, ETH has now pulled back into a critical support area.

The key question is whether buyers can defend this zone or if a deeper correction is on the horizon.ETH Price Technical Analysis

By ShayanThe Daily Chart

On the daily chart, Ethereum has clearly entered a corrective phase, with selling pressure and profit distribution weighing on momentum. This decline has pushed the asset toward the $4K psychological support, which also aligns with the channel’s midline, making it a pivotal level for trend continuation.

If buyers successfully defend this zone, ETH could consolidate before attempting another push higher. However, a decisive breakdown below $4K would likely expose the next key support around $3.5K, where the previous swing low and the channel’s lower boundary converge. Despite the current retracement, the broader uptrend remains valid, though momentum has cooled significantly.

On the lower timeframe, Ethereum recently performed a classic liquidity hunt, sweeping above resistance before reversing sharply and breaking below recent higher lows, an early indication of a potential market structure shift.

Currently, the price is stabilizing around the $4K region, which also coincides with the multi-month ascending uptrend line. This confluence makes $4K a crucial battleground between bulls and bears. For now, ETH is effectively range-bound between $4K and $4.8K, with liquidity clusters concentrated at both extremes.

Until a breakout occurs, the market is likely to remain in a sideways consolidation phase. That said, a sudden bearish breakdown below $4K could trigger a cascade of liquidations, flipping the broader bullish outlook into a bearish scenario.

By Shayan

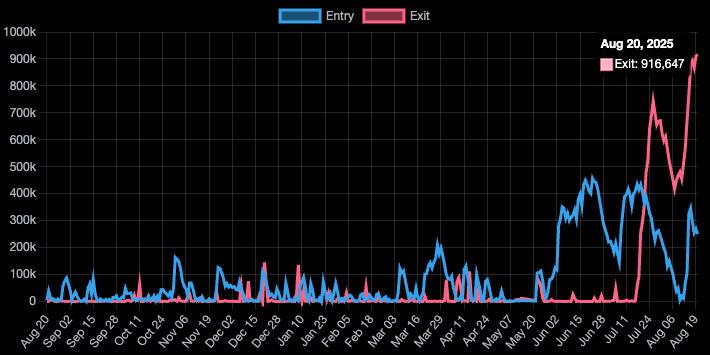

The Ethereum network is experiencing a severe imbalance in its validator dynamics, with a historic surge in validator exits and a sharp decline in new entries. As of August 20, 2025, more than 916,000 validators are queued to exit, the largest exit queue ever recorded.

Unlike previous short-lived spikes, this trend has been accelerating over the past two months, signaling that it is more than just a temporary fluctuation and instead reflects deepening concerns among stakers.

This development carries significant on-chain implications. Validators leaving the network regain access to their 32 ETH deposits plus accrued rewards, a considerable portion of which is likely to flow back into circulation. If even part of this ETH is directed toward selling, it could introduce substantial supply-side pressure on the market.

In effect, the rapidly expanding exit queue acts as an early warning signal of mounting downside risks. Without a corresponding wave of new demand to absorb the unlocked ETH, Ethereum may face a period of heightened volatility, where the market struggles to balance the incoming supply. This setup increases the likelihood of short-term downside pressure, potentially undermining the broader bullish structure unless staker sentiment improves or new buyers step in decisively.

최신 뉴스

CoinNess

2025-08-22 09:33:56

CoinNess

2025-08-22 09:14:40

CoinNess

2025-08-22 09:03:07

CoinNess

2025-08-22 08:49:35

CoinNess

2025-08-22 08:31:15