The Smarter Web Company acquires another $35 million worth of bitcoin as total holdings reach 2,395 BTC

The Block

2025-08-12 17:11:46

UK web design and bitcoin treasury firm The Smarter Web Company announced on Tuesday that it has acquired an additional 295 BTC for £26.3 million ($35.2 million) at an average purchase price of £89,000 ($119,412) per bitcoin.

The acquisition follows the firm's latest £7.6 million raise on Monday from the placement of 3,452,086 new ordinary shares at approximately £2.21 each as part of its ongoing 14 million share subscription tranche. With 4,490,000 shares left to place, a new subscription agreement with similar terms is expected once the current tranche is completed, the firm said.

The London-listed firm now holds a total of 2,395 BTC — bought at an average price of £82,399 ($110,555) per bitcoin for a total cost of £197.3 million ($264.8 million), maintaining its place in the top 25 public bitcoin treasury companies as as the number one UK corporate holder, according to Bitcoin Treasuries data.

With bitcoin currently trading for $118,917, according to The Block's BTC price page, the firm's holdings are worth approximately $284.8 million, meaning The Smarter Web Company is up around 7.6% or $20 million on its investment on paper. The firm currently retains £700,000 ($942,000) in available cash in its treasury to be deployed into bitcoin.

Pushing to join the public bitcoin treasury companies' top 20

The rapid pace of the Smarter Web Company's bitcoin acquisitions compared to many of its peers, announcing the purchase of more than 1,500 BTC in July alone, sees it rapidly climbing the ranks to 23rd among the now 152 public company holders, per Bitcoin Treasuries data — up from 36th a month ago, with CEO Andrew Webley eyeing the top 20 within weeks.

Strategy, MARA, Tether-backed Twenty One, Adam Back and Cantor Fitzgerald-backed Bitcoin Standard Treasury Company, Riot Platforms, Metaplanet, Trump Media & Technology Group, CleanSpark, Coinbase, and Tesla make up the remainder of the top 10, with 628,946 BTC, 50,639 BTC, 43,514 BTC, 30,021 BTC, 19,239 BTC, 18,113 BTC, 15,000 BTC, 12,703 BTC, 11,776 BTC, and 11,509 BTC, respectively.

On Monday, market leader Strategy announced it had purchased another 155 BTC to near 3% of bitcoin's total 21 million supply on the fifth anniversary of its first bitcoin buy in 2020.

Like those firms, The Smarter Web Company uses a key performance indicator known as "BTC Yield" to assess the effectiveness of its bitcoin acquisition strategy in driving shareholder value. BTC Yield represents the percentage change from period to period of the ratio between the firm's bitcoin holdings and its assumed diluted shares outstanding. Year-to-date, The Smarter Web Company said it has achieved a BTC Yield of 55,069%, and 76% over the past 30 days.

What is The Smarter Web Company?

The Smarter Web Company offers web design, development, and online marketing services, generating revenue from setup fees, annual hosting fees, and optional monthly charges. It has accepted bitcoin payments since 2023 and began integrating a bitcoin treasury policy in April as part of its belief in Bitcoin's role in the future financial system.

The David Bailey and UTXO Management-advised firm's 10-Year Plan focuses on expanding its client base organically and through selective acquisitions of bitcoin to deliver long-term value to shareholders and fund future growth.

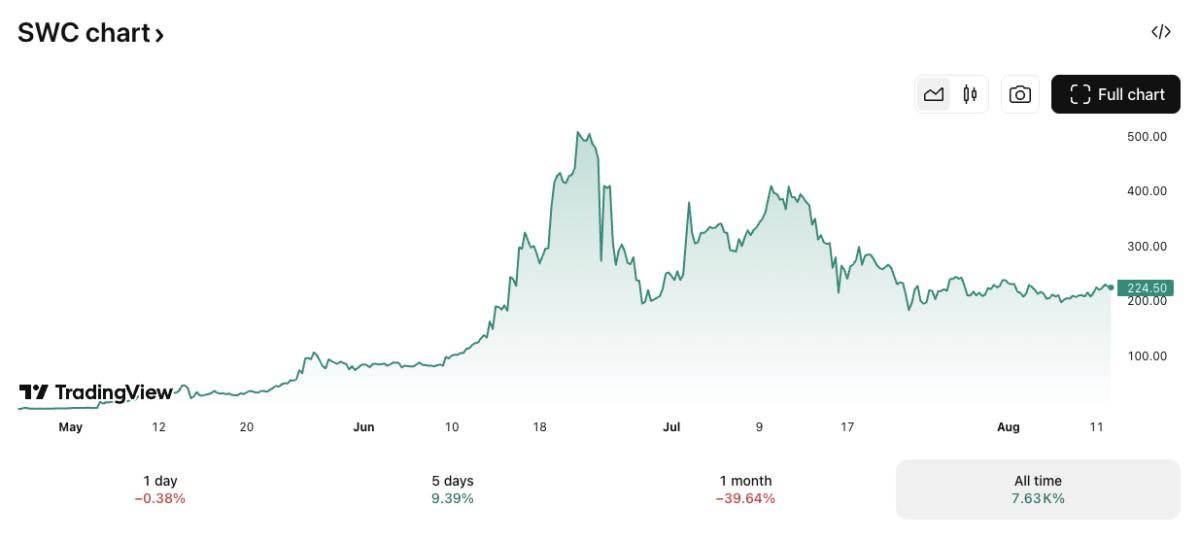

The Smarter Web Company was listed on the UK's Aquis Stock Exchange under the ticker SWC through a reverse takeover and began trading on April 25. The firm's stock subsequently rose nearly 20,000% to £605 following the announcement of its bitcoin treasury strategy, before plunging 70% to a low of £192.66, according to TradingView.

SWC is currently trading down 0.3% on Tuesday at £224.50, having gained 9.5% over the past week. The company's $415.2 million value means its market cap-to-net asset value (mNAV) ratio currently sits at 1.46x, slightly below Strategy's 1.52x.

SWC/GBP price chart. Image: .

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

최신 뉴스

CoinNess

2025-08-14 22:39:51

CoinNess

2025-08-14 22:30:29

CoinNess

2025-08-14 22:25:39

CoinNess

2025-08-14 22:19:13

CoinNess

2025-08-14 22:12:07